Chart of the Month – Emerging markets’ affinity for luxury: a growing trend

Chart of the Month – Emerging markets’ affinity for luxury: a growing trend

Source: Bloomberg, NS Partners. Stocks are presented for information only. NS Partners has not acquired any rights or license to reproduce the trademarks or logos set out in this document.

Are you currently considering investment opportunities in emerging markets, all while maintaining a strong presence in assets listed on both European and American markets?

Luxury might just be the ideal solution.

While the luxury sector began the year on a strong note, it has faced challenges in the past two months. Luxury equities saw a decline in August and September, attributed to various factors such as increasing interest rates, disappointing economic data from China including renewed concerns about the real estate market potentially affecting consumer demand and shifts in analyst recommendations. These elements have introduced uncertainty regarding these growth assets.

Nevertheless, the financial results reported during the first half of the year provide an encouraging outlook and underline the resilience of this thematic investment. Many of the leading luxury groups are predominantly listed on European and American markets. However, it is essential to assess the extent to which their revenue is derived from emerging markets. A global estimate is therefore essential.

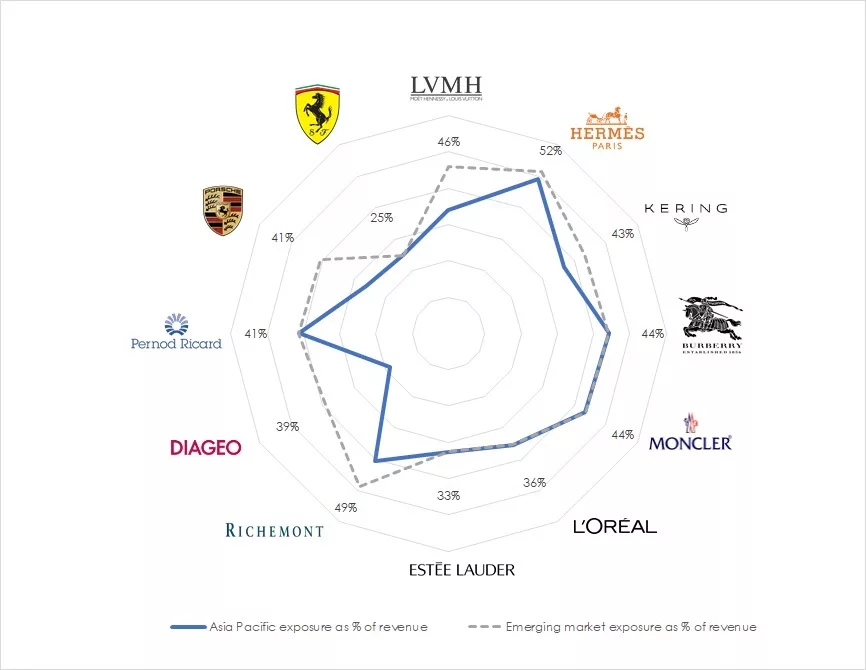

When focusing on the most prominent and distinguished luxury brands, such as LVMH, Hermès, Kering, Moncler, and Burberry in the realm of soft luxury category, Estée Lauder and L’Oréal in the beauty and cosmetics, Compagnie Financière Richemont for hard luxury, Diageo and Pernod Ricard for spirits, and Porsche and Ferrari for automobiles, it becomes evident that the Asia-Pacific region, predominantly represented by China, plays a significant role. This region accounts for over 25% of first-half 2023 revenue. Notably, Hermès leads the pack with a substantial 49% contribution, followed closely by Burberry and Moncler at 44%. Similarly, for Compagnie Financière Richemont and Pernod Ricard the dynamic market contributes 41%. Should we broaden our perspective to encompass other emerging regions, such as for example Latin America and Africa, we find that major luxury groups maintain exposure levels exceeding 35% to emerging countries.

Why are emerging countries catalysts? The luxury sector is buoyed by consumption, increasingly driven by the expanding middle class. Emerging countries are experiencing notable economic growth, with China leading the way and poised to maintain its position at the forefront. Asian consumers aspire to showcase symbols of success and embrace cosmopolitan lifestyles. This year, however, China experienced a slowdown in growth, recovering more slowly than expected. Nevertheless, by 2030, it is predicted that the Chinese, in their own country, will be the largest consumers of luxury goods, according to the renowned firm Bain and Company.

Another rapidly growing economy making headlines is India which is re-entering the global economic spotlight on several fronts. Although luxury consumption in India is currently relatively low, it is showing substantial growth, with a remarkable 26% year-over-year increase. Millennials are the driving force behind the flourishing luxury industry, as India boasts the largest share of millennial consumers among major international economies, exceeding 30%. This demographic profile, combined with rapidly rising urban household incomes, is fueling the swift growth of luxury consumption in India. The Indian economy appears to be on a robust growth trajectory, with one of the fastest GDP growth rates among major world economies.

Investing in emerging markets through well-established and well-managed European and American companies is a prudent strategy. The luxury sector has demonstrated resilience and is considered an all-weather investment. In many cases, the Price/Earnings ratio (P/E) for these companies has returned to pre-COVID levels. Historically, buying luxury company stocks during market corrections has proven to be a profitable investment strategy.

Past performance is not indicative of future results. The views, strategies and financial instruments described in this document may not be suitable for all investors. Opinions expressed are current opinions as of date(s) appearing in this material only. References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. NS Partners provides no warranty and makes no representation of any kind whatsoever regarding the accuracy and completeness of any data, including financial market data, quotes, research notes or other financial instrument referred to in this document. This document does not constitute an offer or solicitation to any person in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation. Any reference in this document to specific securities and issuers are for illustrative purposes only, and should not be interpreted as recommendations to purchase or sell those securities. References in this document to investment funds that have not been registered with the FINMA cannot be distributed in or from Switzerland except to certain categories of eligible investors. Some of the entities of the NS Partners Group or its clients may hold a position in the financial instruments of any issuer discussed herein, or act as advisor to any such issuer. Additional information is available on request.

© NS Partners Group