Chart of the Month – Cloudier…… with cleaner skies

Chart of the Month – Cloudier…… with cleaner skies

Source: NS Partners, Bloomberg

A healthy bull market needs an underlying sustainable and massive investment cycle; we should feel lucky to figure out that we happen to live through two of them.

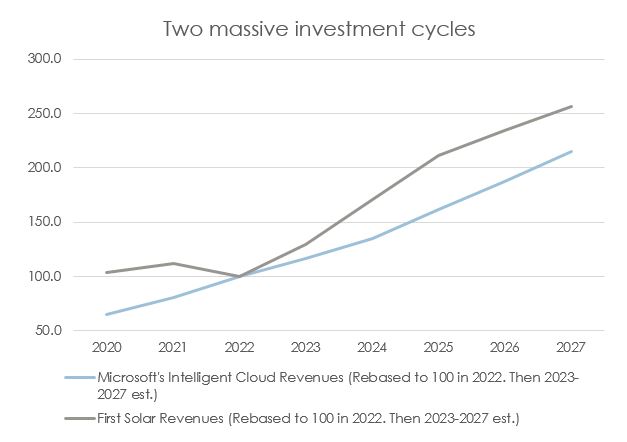

The first, which started when Apple launched its first iPhone in June 2007, had to face very adverse early days as the infamous Great Financial Crisis occurred soon thereafter, but it is still well alive today: DIGITALISATION. It is in everybody’s mind, and it is everywhere. From companies, to individuals, to public organizations, no one escapes the immense investments required to keep up with the unstoppable digitalisation growing footprint. It is best illustrated by Microsoft’s Azure (cloud) business highlighted in the chart of the month, which shows revenues more than doubling for this activity between 2022 and 2027, i.e. a 16.7% CAGR. This impressive growth is supported by ongoing investment expenditures, as well as the new race for Artificial Intelligence, which will require even more Cloud resources going forward. Expect all major Cloud and AI players to maintain a very high level of investments in data centers, software, hardware and semiconductors.

This will inevitably go in sync with steadily increasing demand for electricity; this comes at a time when the world needs to foster its sustainable power production in general in order to move towards carbon neutrality. And that’s precisely the second massive investment cycle: CLEANER ENERGY (which you can derive into greener energy, energy efficiency, sustainable energy, you name it). Electricity demand is expected to grow slightly faster than GDP until 2030, with an unprecedented change in the production mix, as renewables will take very substantial market share. This is the other line of the chart of the month, which shows First Solar’s projected revenues between 2022 and 2027: expected CAGR here is close to 21%!

The beauty of this second investment cycle lies in its eclectism: almost all sectors will be part of it, from materials to semiconductors or industrials. That’s a stock picker’s dream, because as of today, in digitalisation like in cleaner energy, some stocks already trade at lofty levels, while others show super attractive valuations.

We have many good news here: hopefully a solid bull market, and the possibility for active management to deliver superior returns. It gets cloudier, while we should have clearer skies.

Past performance is not indicative of future results. The views, strategies and financial instruments described in this document may not be suitable for all investors. Opinions expressed are current opinions as of date(s) appearing in this material only. References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. NS Partners provides no warranty and makes no representation of any kind whatsoever regarding the accuracy and completeness of any data, including financial market data, quotes, research notes or other financial instrument referred to in this document. This document does not constitute an offer or solicitation to any person in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation. Any reference in this document to specific securities and issuers are for illustrative purposes only, and should not be interpreted as recommendations to purchase or sell those securities. References in this document to investment funds that have not been registered with the FINMA cannot be distributed in or from Switzerland except to certain categories of eligible investors. Some of the entities of the NS Partners Group or its clients may hold a position in the financial instruments of any issuer discussed herein, or act as advisor to any such issuer. Additional information is available on request.

© NS Partners Group