Luxury: diversity and all-terrain performance

Luxury: diversity and all-terrain performance

Why not invest in luxury? The sector has proved its resilience and adaptability.

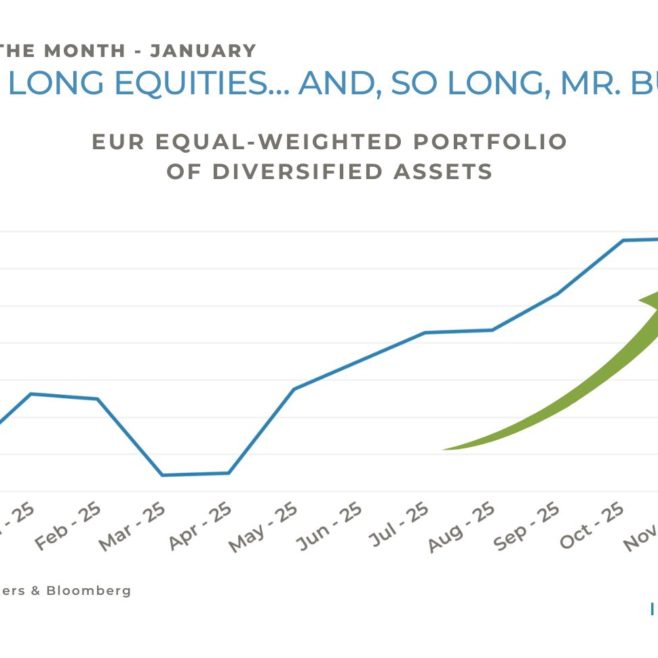

Like other industries, luxury was hit hard in 2020 by lockdowns and the abrupt stop of international travel. After bouncing back in 2021, luxury stocks ended 2022 in the red. This negative year, however, gave investors some good opportunities. The big luxury groups saw their valuations first rocket then settle back. Multiples now look high but remain reasonable.

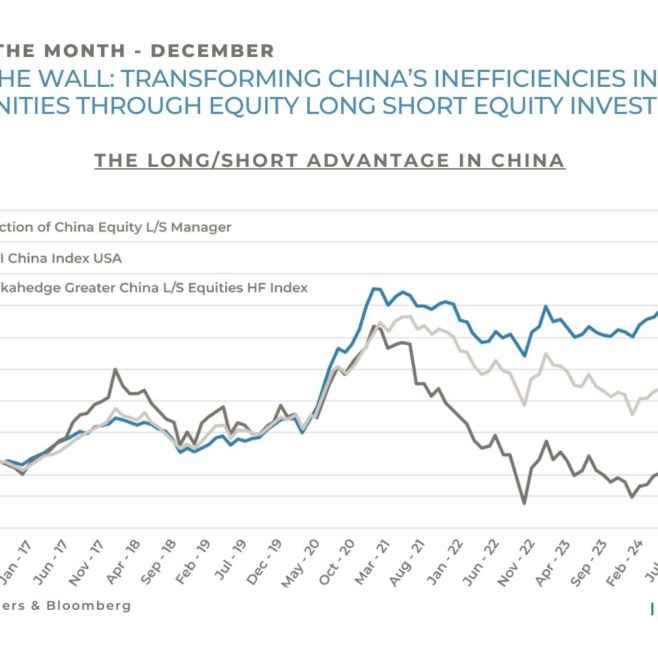

Luxury a big winner from China’s reopening

Luxury got off to a flying start this year, riding the surge of optimism on China, a big driver for the sector. Sales had actually grown strongly in the United States and Europe last year, despite China being locked down due to its zero-Covid policy. China’s reopening and the return of domestic and international flights now point to a catch-up surge and, for the luxury sector, a year of rising sales and revenue.

Luxury premium back down despite its 5-year outperformance

The last five years have included plenty of headwinds: Covid-19, the war in Ukraine, rising interest rates, inflation, etc. Despite this, over the last 5 years Hermès, LVMH and Ferrari stocks have gained +223%, +177% and +129%, respectively. The same goes for earnings per share, up +155% at Hermès and LVMH and +80% at Ferrari. Over the same period, luxury as a sector outperformed the market by +15.8%. Of course, some sub-sectors were impacted, particularly travel and hospitality which are heavily correlated with tourism.

Luxury stocks traditionally trade at a premium to the market. What happens to this premium can be used as an entry signal. And, after shooting up, it has fallen back to attractive historical lows.

Diverse geographies and consumers

Investing in luxury means investing in a sector sheltered by high entry barriers, in companies with sound and healthy balance sheets, growing revenue and usually double-digit margins. Less obviously, it also gives you exposure to emerging markets. Hermès, Kering, Burberry, Salvatore Ferragamo, Compagnie Financière Richemont and Swatch, for instance, make between 38% and 47% of their revenue in Asia.

Until recently, most of the shopping by this clientele was done while travelling abroad. To expand local consumption in China, the luxury majors built up local exposure, opening multiple stores and creating websites to target these markets. China’s reviving consumption is therefore good news, particularly as Chinese consumers have built up billions of yuan in unspent savings over the last three years.

Luxury can cope with anything

Inflation is still a factor. However, companies in the luxury sector command strong pricing power as demand for luxury goods is fairly inelastic to price. This means they can protect their margins. But what happens to the luxury sector in times of recession? The sector’s consumer base is wider spread and less sensitive to economic slowdown than most and it benefits from a simultaneously defensive and growth profile. Luxury houses are cash rich and free to make acquisitions. Groups are diversifying, led by the biggest of them all LVMH, which is active in soft luxury (clothes, shoes, leather goods, etc.), watches and jewellery, perfumes and cosmetics, wines, hotels, and more. This year, Kering said it was creating a strategic division to break into the beauty sector. Thanks to a huge and expanding consumer base, the sector has room to grow 60% by 2030, according to consultants Bain & Company. Generation Z is in the front line. Gen Z-ers are demanding and buy their first luxury goods at around 15, 3-5 years younger than their Millennial predecessors. Generation Z and the upcoming Generation “Alpha” (younger but with similar consumption patterns) should make up around a third of the luxury market by 2030. In response, luxury is adapting, digitising and expanding its footprint on social media and in the metaverse. It is also embracing environmental and social issues, prioritising transparency in processes, supply lines and management of second-hand goods.

So the constantly evolving luxury sector is doing rather well and its fundamentals remain sound and intact. It remains resilient and able to grow profits whatever the economy throws at it.

Past performance is not indicative of future results. The views, strategies and financial instruments described in this document may not be suitable for all investors. Opinions expressed are current opinions as of the date(s) appearing in this material only. References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. NS Partners provides no warranty and makes no representation of any kind whatsoever regarding the accuracy and completeness of any data, including financial market data, quotes, research notes or other financial instruments referred to in this document. This document does not constitute an offer or solicitation to any person in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation. Any reference in this document to specific securities and issuers are for illustrative purposes only, and should not be interpreted as recommendations to purchase or sell those securities. References in this document to investment funds that have not been registered with the Finma cannot be distributed in or from Switzerland except to certain categories of eligible investors. Some of the entities of the NS Partners group or its clients may hold a position in the financial instruments of any issuer discussed herein, or act as advisor to any such issuer. Additional information is available on request.

© NS Partners Group