Chart of the Month – Artificial Intelligence & Hedge Funds

Artificial Intelligence & Hedge Funds

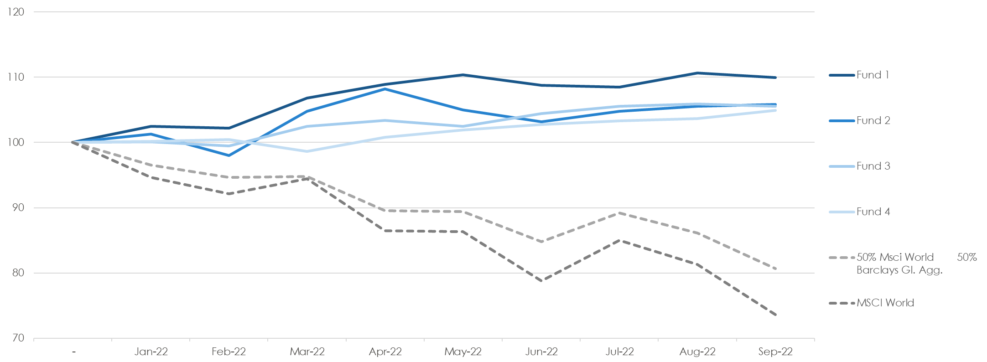

Source: NS Partners, Bloomberg

Artificial Intelligence (AI) has been mentioned for quite some years by traders from the quant world. Nevertheless, it was reasonable to wait a few years before we could establish valid congruence between this innovative data management approach and financial market intricacy. After 4 years investigating that space, we started to see some signs of maturity and constructive outcomes back in 2020-21. So, after a 5 years hiatus and no quant strategy exposure, we made the decision to allocate to some AI related strategies back in Q4 2021 and increased this segment in Q1 2022 to reach up to 20% of the strategy HF Uncorrelated allocation at the end of Q2 2022.

One of the most interesting features of these strategies is obviously their self-learning ability, both about their mistakes and great ideas. This also allows to address a more intricate market behavior: time windows. The ability to grow or shrink certain segment of a book not only from asset class point of view, a trend or momentum point of view but also considering the time frame value of a trade bring undeniable robustness to a trading strategy. This is one of the strength AI is bringing to the equation since it requires non-linear and multi-dimensional approach, in other words non-intuitive interactions

Nevertheless, an important aspect of our side of the job when picking such strategies, is to avoid to aggregate the same type of risk just because they adding value as such. AI and how it is used can protect your investment from alpha decay…the enemy of quant traders.

The graph attached is showing that yet it is possible to find generally uncorrelated strategies vs. generic markets using advanced data management but almost as important, uncorrelated strategies between each other. Some of that diversification can easily be achieved by differentiated asset classes exposure, but the key element resides in the granularity with which managers exploit the strength of AI yet with positive alpha in mind.

The four managers now part of the strategy allocation are showing such quantitative features and bring a well needed support in the very difficult markets we are dealing with this year.

Past performance is not indicative of future results. The views, strategies and financial instruments described in this document may not be suitable for all investors. Opinions expressed are current opinions as of date(s) appearing in this material only. References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. NS Partners provides no warranty and makes no representation of any kind whatsoever regarding the accuracy and completeness of any data, including financial market data, quotes, research notes or other financial instrument referred to in this document. This document does not constitute an offer or solicitation to any person in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation. Any reference in this document to specific securities and issuers are for illustrative purposes only, and should not be interpreted as recommendations to purchase or sell those securities. References in this document to investment funds that have not been registered with the FINMA cannot be distributed in or from Switzerland except to certain categories of eligible investors. Some of the entities of the NS Partners Group or its clients may hold a position in the financial instruments of any issuer discussed herein, or act as advisor to any such issuer. Additional information is available on request.

© NS Partners Group