Is thematic investing over?

After valuations have adjusted in 2022, the trend will continue.

During the previous 5 years, thematic investing has been very popular in the asset management industry with a proliferation of many funds and ETFs. During the current year, we have seen horrible performances in many of these themes: Cloud companies lost 36% (until 30-nov-22), Hydrogen related investments lost 34%, new agri-food companies tumbled 26%, blockchain ETFs lost 81%, genomics 35% and probably the best known investment vehicle in thematic investments, ARK Innovation, lost 60%.

The main reason for this dramatic fall was the raise on interest rates by central banks, that put pressure on valuations, specially on companies that rely more on future earnings. Another reason is that some of these themes lacked profitability in two senses, either the companies were not still making money (hydrogen, cloud), or the theme did no have solid companies to invest in (blockchain, agri-food).

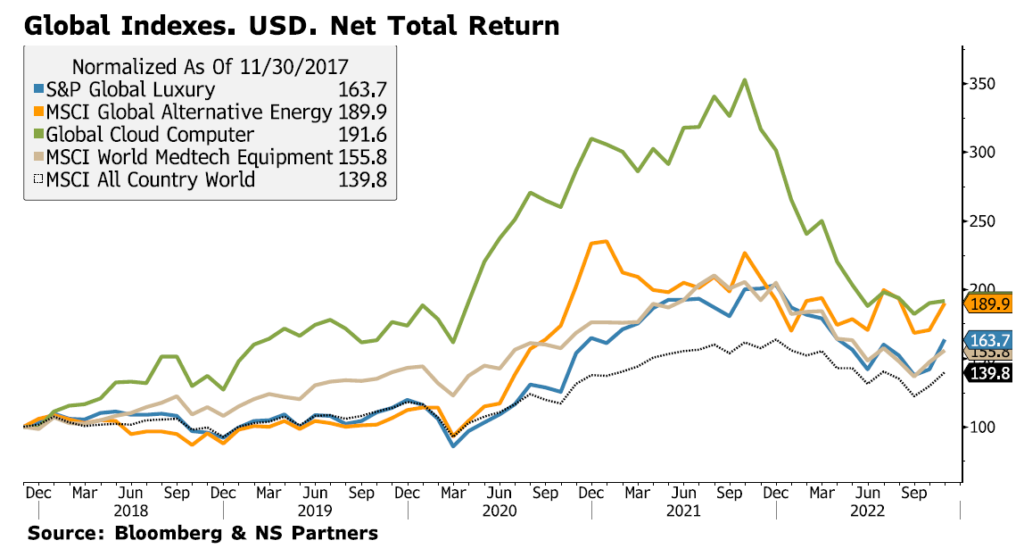

Once interest rates have been hiked and valuations are more “normal”, we are starting to look again at themes selectively. Although there may be many which are good, we have chosen four. The graph below shows the past performances, although we do know that they do not guarantee future returns.

LUXURY GOODS: All the positive drivers are still valid: Growth of the middle class in emerging markets, very high barriers of entry and good management from the global leaders. A good example is LVMH which is expected to grow revenues by 22% in 2022.

SUSTAINABLE OR ALTERNATIVE ENERGY: Probably the most important theme in the investment world and in our personal lives. The world economy is migrating to net-zero carbon emission in 2050 (China and India later on), and this will require huge changes with new investment ideas: solar panel technologies, wind turbine technologies, batteries, electrolysers to produce hydrogen, hydrogen fuel cells, new nuclear reactors, new isolation materials to save energy, heat pumps to save energy, electric vehicles, new semiconductors used in the electric vehicles, carbon sequestration, metals needed for the energy transition like lithium, copper, nickel, rare earths, cobalt, uranium, etc, Governments are very well aware of the need to make this energy transition and they are promoting investments (Inflation Reduction Act in the US) in all these fields.

HEALTH CARE – MEDICAL TECHNOLOGIES: Ageing population is still a trend and the best way to profit from it is to invest in Health Care. Within health care, medical technologies is our preferred theme: There is a stable growth, there continue to be innovation (glucose measure in real time, automatic injectable insulin, genome analysis, etc), high barriers of entry and no special pressure from politicians to control prices. On top of that, it is a resilient trend in recessionary periods like the one we are facing now.

DIGITALISATION – CLOUD: Digitalisation is very widespread in our personal and professional lives. Among the many themes available, we have chosen Cloud as an idea with very high growth (35% increases in revenues in 2022), with a variety of companies to choose, and with very ample implications like cyber security on the cloud, consulting cloud services, corporate IT departments moving hardware and software to the cloud, companies changing their business models to be cloud-centric, etc. This theme had a big ride and a big fall (Green line in the chart), but once valuations have stabilized to more reasonable levels, the trend is expected to continue.

To conclude, there are good themes where (1) we have abnormal growth, (2) high barriers of entry, (3) good universe of companies, and (4) reasonable valuations now, although not cheap. Let’s remember a famous sentence from Warren Buffet: “It is far better to buy a wonderful company at a fair price than a fair company at a wonderful price”.

Past performance is not indicative of future results. The views, strategies and financial instruments described in this document may not be suitable for all investors. Opinions expressed are current opinions as of the date(s) appearing in this material only. References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. NS Partners provides no warranty and makes no representation of any kind whatsoever regarding the accuracy and completeness of any data, including financial market data, quotes, research notes or other financial instruments referred to in this document. This document does not constitute an offer or solicitation to any person in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation. Any reference in this document to specific securities and issuers are for illustrative purposes only, and should not be interpreted as recommendations to purchase or sell those securities. References in this document to investment funds that have not been registered with the Finma cannot be distributed in or from Switzerland except to certain categories of eligible investors. Some of the entities of the NS Partners group or its clients may hold a position in the financial instruments of any issuer discussed herein, or act as advisor to any such issuer. Additional information is available on request.

© NS Partners Group